Gold Market Update: Sentiment At Inflection Point While US Policy Errors Supportive

|

Gold Market Update: Sentiment At Inflection Point While US Policy Errors Supportive |

|

As we reflect on 1H22 and where the financial markets have traveled, we believe there was an historical event that transcends the gold markets as well as significant action in the metals space.

First and foremost, 1H22 will likely go down in the history books as the moment when a new financial system came into focus. This will benefit gold greatly.

This will have a dramatic impact on Americans in the years ahead. Specifically, Biden’s decision to break the cardinal rule of reserve currencies and block Russia’s use of the dollar has triggered an inflection away from the dollar. No nation wants to hold dollars in reserve if they may be confiscated at Biden’s whim.

A new financial system based on commodities and commodity currencies is gaining traction exemplified by the Ruble’s strength vs. the dollar since Russia’s invasion. American media has been silent in detailing the ruble’s strength and how this is an indication the world is voting with Russia and against Biden.

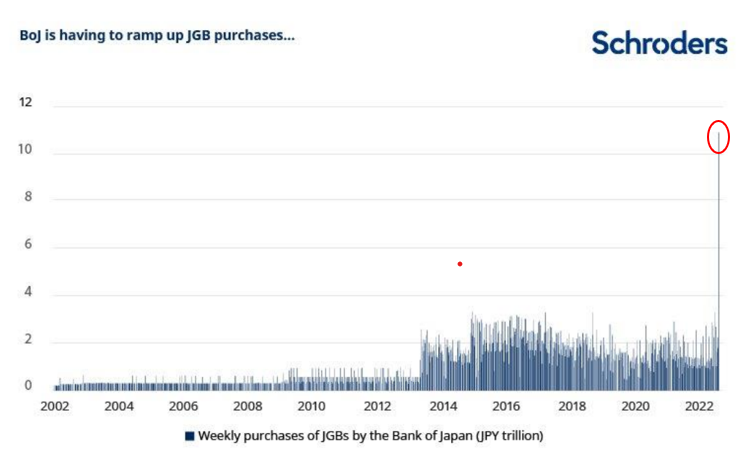

The world needs real assets more than it needs dollars and we have just witnessed the equivalent of Bretton Woods II’s opening session. Notably Russia is tying its currency to gold and US allies are covertly breaking ranks to side with Russia while other major nations are doing so overtly. If Japan which has acted like a slave to US strong-arm tactics triggering the implosion of the Yen does what is in the nation’s self-interests, dollar weakness will likely ensue globally matching the diminished purchasing power of the greenback here in the States. Consider this chart which shows the Ponzi scheme that is Japan. The chart shows how much of the nation’s debt their own central bank is forced to now buy itself to avoid rates from rising materially: |

|

Gold advanced in virtually all currencies globally and outperformed the US stock market by 19% in 1H22 and the tech index by 29%. Notably US investors barely reduced their stock exposure amidst the painful start to the year maintaining allocations north of 40%.

If US investors decide to take a little money out of equities, there will continue to be pressure on equities.

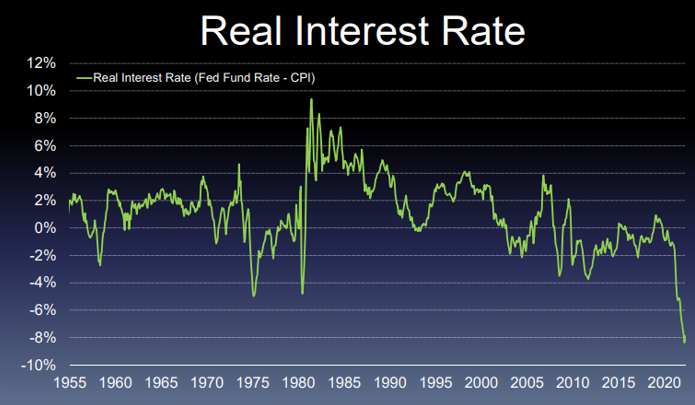

Bonds also had their worst start to the year in over a century while ten-year bonds had their worst start in over 200 years. This is the case even though rates still are nowhere near matching the levels of inflation. Bondholders are losing more purchasing power by holding cash, CDs, and fixed income than at any time in the last seventy years if not longer. This chart shows that as real interest rates measure coupon rates less inflation: In addition to the pain that plummeting real rates are causing on Americans, consider the dramatic increase in monthly mortgage payments which will weigh on many segments of real estate. Less buyers can afford monthly payments at today’s rates than when mortgage rates were half what they are today:

Perhaps at that moment Americans will finally question the wisdom of holding $17 trillion in cash as households do today when the dollar has lost more than 80% of its value in our lifetimes. Worse is that dollar has lost 95% of its value since the Fed began transforming prosperity into poverty with its policy errors. Consider in contrast that gold is up 50x in that same time span underscoring why the Fed in a rare moment of honesty admitted:

"Gold is a currency. It is still, by all evidence, a premier currency, where no fiat currency, including the dollar, can match it." -Alan Greenspan, Chairman of the Federal Reserve

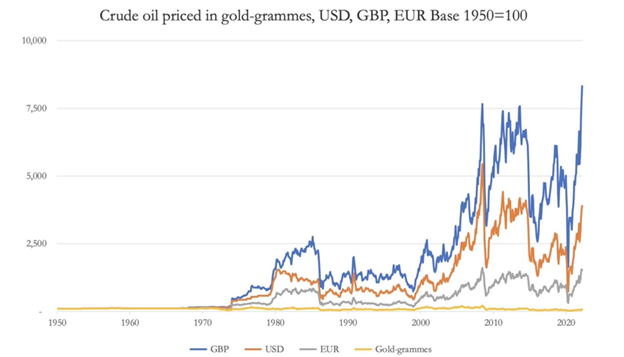

And if Americans resent public policy as I do that has pushed gas to $5/gallon, here is an example of how having a gold cash allocation makes such a difference for families. This chart by Alasdair MacLeod shows how the price of gas has exploded when purchased in dollars and other fiat currencies … but how the price of gas like other commodities has been rock steady when priced in gold.

History shows gold simply preserves the purchasing power of investors, the most important and most valuable attribute of one’s safe money allocation: The Comex’ update released after the market close on Friday showed that sentiment among hedge funds towards gold now mirrors the negative sentiment among retail investors. Moreover, long gold positions among managers are at their lowest levels in three years, silver long positions among hedge funds broached rare negative territory, and platinum positions are short by more than 10%. All of these data points suggest the metals appear close to bottoming.

Corroborating this perspective if one looks at the charts of the metals, they are showing signs that the recent pullback is largely exhausted. In conclusion, we submit Americans have little appreciation as to how sheltered we have been from the dangers of wealth destruction in paper currencies because of our reserve status. 1H22 will go down in history as a watershed moment in financial history when American policy errors accelerated the world’s transition to a new financial order. It is imprudent for American investors not to diversify wealth away from dollar denominated assets in light of this.

Per the data above, as the dollar has lost 95% of its value gold has risen 50x showing how well it has diversified Gold is almost uniquely uncorrelated to stocks bonds and real estate as well.

Premiums have come in with recent weakness and we are live on many forms of silver as well as gold.

Three specials we are offering –

|