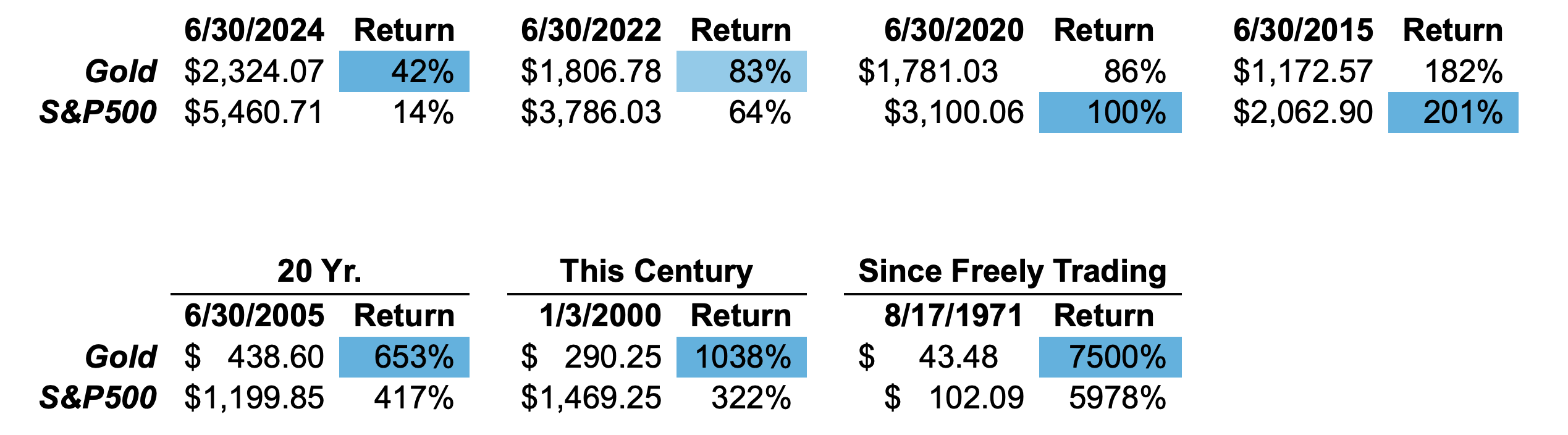

The Numbers Don’t Lie: Can You Handle the Truth?

And year-to-date through June 30th, gold is up 25%, silver 24% — outshining Bitcoin, U.S. equities, international stocks, and bonds.

The message? Gold is doing exactly what it’s designed to do — and then some.

So why does it still get ignored in most portfolios?

It’s Not That Advisors Don’t Get It — It’s That Wall Street Doesn’t Want You To

Most advisors are doing their best within a system designed by Wall Street. A system that prioritizes fee-generating assets, managed products, and what fits into a quarterly report — not what protects families for generations.

And in a world where debt is cheap, money is manipulated, and trillions in stimulus flood the system, physical gold is exactly what you want.

Gold is About Safety — and Still Outperforming

People miss this: gold’s role isn’t just to beat the S&P. It’s to preserve purchasing powerin a world where that power is being drained.

But here’s the amazing part — even with central banks printing trillions and artificially elevating equity prices, gold has still outpaced most asset classes.

What happens when the money-printing slows, the smoke clears, and financial assets get repriced?

History says gold won’t just be standing — it will be soaring.

This Is Bigger Than a Portfolio

If you care about your family’s future — not just next quarter’s return — you need to think generationally.

Most Americans have retirement assets in 401(k)s or IRAs. You don’t need cash - those very same retirement accounts can often be diversified into physical gold and silver.

Yes, you can own it inside your retirement plan.

And if you’re managing family wealth or a trust? Gold should be foundational. The point of a trust is not just to pass on money — it’s to pass on wisdom. Don’t hand your children paper in a world where paper is losing value by the day.

The Smartest Money in the World Already Knows

Central banks are buying record amounts of gold — quietly, consistently, and globally. Countries are repatriating their gold back to their own borders. Why?

Because they see what’s coming.

Per our last report, investors should know that after major credit bubbles, equities fell over 90% in real terms. Daniel Oliver of Myrmikan shared these key facts with investors: The stock market fell 93.6% after the 1929 credit bubble and 96.2% after the 1960s bubble.

And we’re in the process of an even larger credit bubble that will unravel.

If you think that can’t happen here, you’re not paying attention. The people who pull the strings are actively trying to destroy the middle class’s savings while central banks are hoarding gold at record levels.

The storm is forming. The smart money is already in the ark.

Now Is the Time

Gold has already proven itself again in 2025. But don’t wait for the headlines to catch up. By then, the moment may have passed.

God bless you, your family, and this great nation. Happy Independence Day!

Past performance is not indicative of future results.