A White Smoke Week: Rare Moments of Change Swirl Around Us

On May 3, Warren Buffett — one of the most iconic investors of our time — announced his retirement. For over half a century, Buffett has been widely admired for his long-term value investing principles. But while his stock-picking legacy is undeniable, Buffett has also been one of the most vocal critics of physical gold.

That criticism came at a real cost. Just from our conversations with hundreds of clients, it’s clear that millions of Americans avoided buying gold simply because “Warren said gold is dumb.” Unfortunately, the numbers show Buffett may have missed the mark — and in doing so, led others to miss out.

Ironically, gold — often portrayed as a “non-productive asset” — has outperformed the S&P this millennium. This reality, as undeniable as Buffett's success, reveals how conflicted Wall Street is in putting their firms' interests ahead of client interests, despite what their well-choreographed talking points claim. Think for one moment about finance - Conceptually, one should only take more risk if the expectation is notably more return than with a less risky asset. While foresight is never 20/20, the 0% physical gold allocations owned by the US population today are an indictment of the objectivity of the major brokers.

Back in 2010, Forbes published a letter we wrote challenging Buffett’s arguments against gold. Countless investors failed to notice that while Buffett and his former partner Charlie Munger were telling Americans to remain fully invested in the stock market, they were in the process of building record cash hoards — a clear signal of Buffett's concern about market valuations. Berkshire Hathaway entered 2025 with cash of $334.2 billion, close to double the prior year.

And for American investors, who like Buffett felt uneasy about so much market exposure, not only did Buffett counsel them to do exactly the opposite of what he was doing, but Buffett never bothered to show them data reviewing that gold dramatically outperformed the income from T-Bills and other fixed income products.

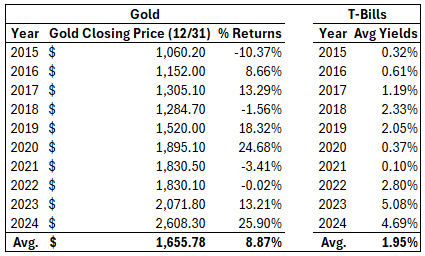

Below, please find the difference in returns of gold versus T-Bills going back the last decade, updated through 12/31/24. As you can see, it has been additive to a portfolio to hold gold among T-Bills and to sell gold in pieces, if needed for expenses, rather than holding only T-Bills and looking to coupons for income.

Gold vs. T-Bill Returns

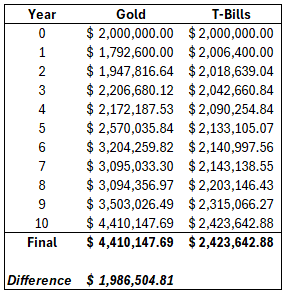

The difference has been material for those who chose to save in gold…

Investing $2m in Gold vs. T-Bills

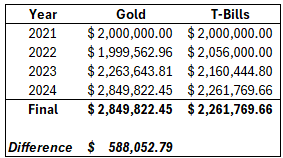

Here is the same study looking more recently, since yields have been higher from the period of 1/1/22 through the end of 2024. Despite the higher yields, in just 3.5 years, it has still benefited investors to hold gold within a portfolio, as gold returned 25% more than T-Bills.

Investing $2m from 1/1/22 through 12/31/24

We expect that in the not-too-distant future, more investors will fully understand that:

- Gold’s performance versus the market would have been even greater were it not for quantitative easing (QE) and the government’s artificial elevation of financial assets and Buffett’s portfolio.

- Buffett’s nonsensical gold comments, absurd from someone as smart as he, were spoken because of pressures he was put under to speak ill of gold to keep investors away from the asset which threatened Wall Street’s debt-based money-making machine.

- In return for speaking inaccurately and negatively about gold, Buffett was promised the late-night calls that would give him sweetheart deals never offered others.

And while America’s most famous stock bull heads for the retirement exit with record cash, ironically in April 2025, American investors purchased a record amount of stocks — the largest monthly buying spree ever. Retail investors did this, despite the rich valuations of financial assets, in full denial of the massive risks that have not been purged from markets. This recklessness with valuations is the type of behavior we have seen repeatedly in the past when, as bubbles began bursting, investors loaded into the markets, thinking a dip was only temporary.

Buffett’s exit was not the only major change this week. Developments in the tech sector, a primary beneficiary of April’s equity inflows, are of a tectonic scale. Under oath in court, Apple admitted Google is now paying Apple over $20 billion annually just to be the default search engine for Apple’s iPhone browser, Safari. Apple also just admitted that for the first time ever in its storied tech history, Apple observed a decline in search volume as users migrate to AI-driven queries and away from the business models that have contributed to the mag 7’s rich valuations.

While mainstream investors continue ignoring these red flares, doubling down on tech, others are quietly laying the groundwork for a different kind of reset. Members of the Trump team are moving forward with proposing gold-backed debt and gold resets. Other Trump advisors are sounding alarms again on the BRICS nations’ moves to de-dollarize and move towards gold. The dollar, the largest asset exposure held by Americans, had another poor week, and some currency strategists, such as Stephen Jen, are warning of an avalanche of dollar selling that could total $2.5 trillion. Treasury Secretary Scott Bessent was on the tape this week, saying that his ability to use sage accounting maneuvers will be insufficient to overcome our debt burden before the end of summer.

And finally, we would be remiss if we did not recognize yet another major change on the global stage as for the first time in history, an American was announced as Pope. White smoke weeks only occur a handful of times in one’s life, and it is captivating to watch this change of office that dates directly to scripture and Jesus’ appointment of Peter as it continues thousands of years later. We hope for the best while he is in office, but if he should become embroiled again in the child-sex scandals as he has in the past, don’t quit. Just join us in praying, fasting, and working while the Holy Spirit leads to take back His church.

Reach out to our team amidst these major changes to learn how gold can give you peace of mind that you are positioning your family as the Bible, financial history, and the laws of finance suggest are prudent. Physical gold can protect you in retirement portfolios in these turbulent waters.

Thank you, God bless, and God bless America.

Past performance is not indicative of future results.