Goldman Leads The Wirehouses In Strategic Gold Retreat

- Weeks after reaffirming to clients that 0% gold allocations were ideal for client portfolios, Goldman Sachs retreated from that position. We expect a similar gold retreat will be followed by financial advisors around the country.

- In an effort to contain the potential damage of its admission, Goldman now suggests that an 8% gold allocation is ideal during inflationary periods. We believe that low metric is as unsupportable an assertion as was its 0% gold recommendation.

- We look at the top quintile of inflationary years since gold began trading freely and present data showing the impact of various allocations on returns and risk as measured by Sharpe.

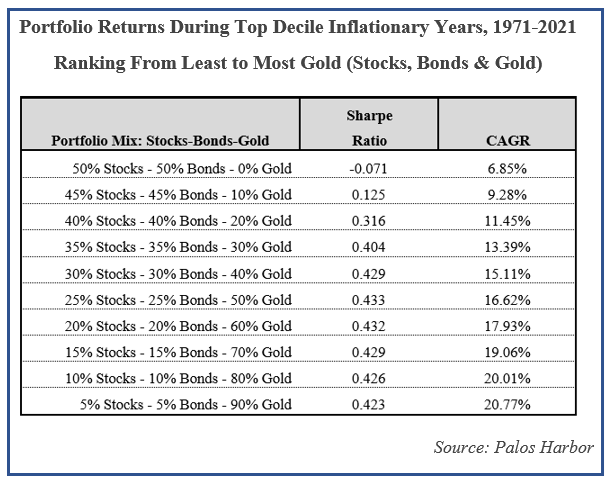

- For investors adding gold to stock and bond portfolios while maintaining 5% allocations to each of the three categories, the data suggests a 90% allocation to gold produces the best returns.

- For investors considering real estate as well as stocks, bonds and gold with at least 10% in each asset class, return is optimized with a 70% allocation to gold.

- Our conclusion is not to push investors to allocate to such high percentages of gold but point to this as another triangulating data point supporting our view that 20% allocations to gold as baseline is appropriate with today’s backdrop. We also suggest investors consider right sizing their gold allocations as an urgent priority.

………………………………….

Earlier this year Goldman Sachs updated and reaffirmed its loud recommendation to clients that a 0% gold allocation was the ideal for portfolios. We showed in multiple reports how historical data does not only refute Goldman’s advice to its clients but that it is glaringly obvious that Goldman’s advice is off base at best. We surmised that over time we will find out once again Goldman has chosen to take the other side of its clients’ positions akin to when Goldman shorted collateralized real estate loans in ’08 while encouraging clients to buy the same securities the firm was betting would go lower.

Last month however Goldman suddenly did an about face and retreated from its 0% gold recommendation. We think this is worth focusing on as the sell-side army of wirehouse advisors are still not encouraging their clients to own physical gold.

What happened to cause the retreat from Goldman’s bearish gold recommendation? Did their compliance department suddenly realize how indefensible their advice was to steer clients away from owning gold? Was their firm’s proprietary gold position too big to have such a negative view on gold for clients in the public domain? Whatever the cause, Goldman sounded a quiet retreat as a sell side advisor, revisiting the role of gold in portfolios without admitting how wrong it had been.

Some of Goldman’s more humorous new insights (humorous only if one is not paying for Goldman’s advice) in its retreat from 0% gold allocations included:

This backdrop of slower economic growth and higher inflation is a difficult mix for balanced portfolios [stocks and bonds].

It is hard not to be sarcastic re Goldman’s newfound understanding of this reality as it is exhaustively covered in Finance 101. Goldman continued:

The value of the 60/40 portfolio … fell about 20% in the first half of 2022, the biggest decline on record for the start of a year, according to Goldman Sachs Research…

Although it stumbled this year, the stalwart 60/40 has been the optimal ratio on average since 1900 to maximize the risk-to-reward for a portfolio made up of only stocks and bonds … However, a portfolio with a slice of real assets, like gold and real estate, performed even better over the long run. In that case, the optimal strategic asset allocation since World War II has been closer to one-third equity, one-third bonds and one-third real assets…

As the report went on, Goldman became more granular:

Rising inflation … is a backdrop that’s very bad for [stock and bond] portfolios, irrespective of valuations… [inflation also] means there’s less diversification potential between equities and bonds…

So, Goldman if you now concede inflation is bad for stocks and bonds … why do still counsel investors to own such huge concentrations of stocks and bonds?

Even having admitted the above, Goldman still penned its clients their perspective:

“A person close to retirement might want a larger proportion of their savings in bonds”

We want to again take the other side of Goldman’s advice here. We cannot imagine a worse asset to put those close to retirement into today that bonds. Given the threats to the long-term purchasing power of the dollar as well as the inflationary tinderbox in place that destroys the value of bonds why subject mature clients to such risk? We strongly encourage anyone having long bond exposure, especially older investors, to think through the possible scenarios and risks of owning bonds.

Returning however to Goldman’s new realization that gold is suddenly appropriate for investors, it strikes us that this note was simply the first round of Goldman’s retreat as it is still is not being forthright with its clients…

Goldman Sachs Research has run the numbers and found that a roughly equal weight (about 25% in each) between real estate, infrastructure, gold and a broad commodity index has led to the best risk-adjusted performance in periods of high inflation.

Really?

Finance is supposed to be about track records and the data suggests that Goldman is again making statements that are unsupportable.

To suggest that its data set dates to 1900 as its report references and is broad enough to support research on infrastructure, a broad commodity index, and real estate beyond narrow home data, is simply a conclusion that raises eyebrows among researchers. The Dow Jones had not even been created at that point nor had the S&P, NAREIT or the Comex making meaningful data difficult to come by if even in existence.

Having said one third of a portfolio should be in real assets and that 25% of a real asset allocation should be in gold, Goldman is however telling its clients that its new recommended gold allocation has increased from 0% to 8.25%.

In light of Goldman’s superficial assertion that 8% gold allocations are now ideal, we thought investors may benefit from a real look at returns data when inflation has been strong. What is reality?

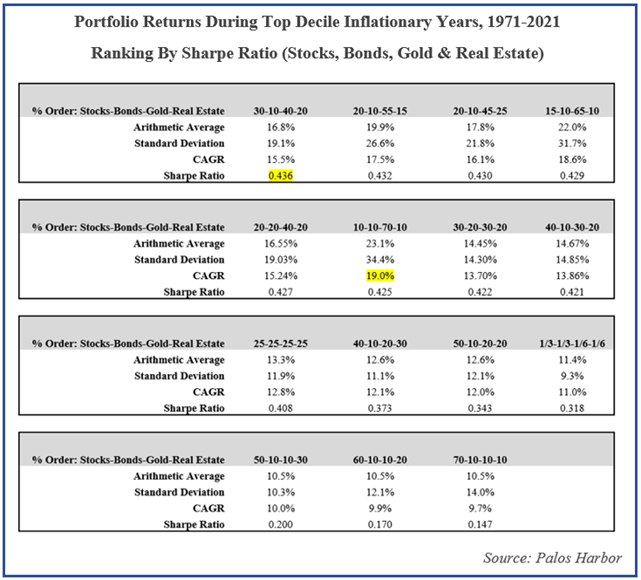

We reviewed the top quintile (top 20%) of the most inflationary years since gold began trading freely. We then tested what allocation mix would have been most advantageous for investors to have had among stocks, bonds, real estate and gold during those inflationary years. We assigned each asset category a minimum of a 10% weighting to give the portfolio some balance.

The data showed that in contrast to Goldman’s 8% gold allocation, investors seeking returns would have been best served maxing out on a 70% gold allocation, leaving only the minimum required portfolio allocation of 10% stocks, 10% bonds and 10% real estate exposure. Investors seeking the highest Sharpe Ratio would have still allocated 40% of their portfolio to gold.

Goldman’s clients should pause and reflect on what we are saying here because either we are completely wrong in our data analysis or Goldman and the wirehouses are advising clients very so poorly in recommending such minimal gold allocations.

Don’t just go with what a lettered advisor tells you is the right thing to do. This is your money. And history suggests there will not be an easy reset button if the Fed loses control of its confidence game.

Having said that, there are countless combinations of asset mixes to consider. What we present above is just a small subset of possible allocations and our point is not to suggest that investors should have gold allocations of at least 70%.

What should be jumping out to rational investors however is that the suggestion of minimal gold allocations during inflationary periods is so wrong, it is hard to justify that a recommendation of 0-8% is not a deliberate misrepresentation.

Our baseline suggestion to investors is that 10% gold allocations under normal conditions is an appropriate allocation. However, in this unique debt cycle where we have synchronized global bankruptcies among the world’s most widely used currencies, a more defensive than normal allocation is warranted. We suggest in this environment a 20% allocation to gold is a more appropriate baseline allocation.

For those who may be new to understanding gold, it is critical to realize that gold is a very desirable asset to use as the cornerstone of constructing your portfolio. Three of the most important reasons for this truth include:

- No matter what the stress or conditions, gold has never lost all its value and it carries no liabilities.

- Gold has proven itself to be inversely correlated to stocks, bonds and real estate, meaning when those assets are stressed, gold has tended to perform well.

- Today as the supply of gold faces a production decline, the value of the world’s gold to global wealth is <1%. That means that investors are very under allocated to gold at a time when no major sovereign currencies can pay back their debts and the supply of gold is in the process of contracting.

………………………………….

But Why Isn’t Gold Performing Better In This Environment Given Inflation Today?

Many investors ask us this question and the answer is simple.

Consider that if one added up all the gold investments in the world, gold is approximately a $10 trillion dollar market worldwide. In comparison, the bond markets are approximately $150 trillion.

Realize also that all assets price off of the bond markets.

When long term bond yields are low as they are today, the valuations of equities and real estate will be far richer than when bond yields rise. This simply has to do with discounting the cash flows an investor would expect from those assets over time which are worth less if inflation is devouring purchasing power.

As the centerpiece of modern capital markets, bonds are in theory priced by market forces and market participants. In free markets if inflation was at 10%, bonds may yield closer to15% --- 10% to cover the rapidly decreasing purchasing power of the underlying bond from inflation, and then 5% to pay the lender for the use of his money. Makes sense, doesn’t it?

But today the capital markets are not priced rationally because markets today are distorted by government purchasing. The government has thrown its immense balance sheet into the markets and bought so many bonds that the pricing of bonds is utter nonsense. Today, bond yields are at 3% while inflation is closer to 10%. This means that some poor investor is buying bonds knowing he will lose 7% of his money in doing so. Who would do such a thing? Only government that prints money it doesn’t have and which doesn’t care if it destroys its citizens wealth as long as it is reelected. We have seen this play out again and again dating to ancient Greece – both the motives and the outcome.

And so, the real question to understand as to why gold isn’t materially higher in this environment is simply this:

Why is the bond at 3% with inflation at 10%?

No one can answer that question in any way other than to say that pricing of capital markets is absurdly off today. Virtually every stock or asset price you see on your computer screen, pricing any asset you own, is a mirage.

As you look through the fog around this mirage you will see that bonds are obviously artificially rich, far richer than where fair value would price fixed income.

That means inversely correlated gold is artificially cheap.

As long as bonds remain artificially rich, gold will likely be cheaper than fair value.

While this may be disappointing to investors who are long gold now given human nature prefers to see quick rewards, think of asset prices this way:

If you are enthused about your portfolio returns on your stocks, bonds or real estate now and want to buy more of those assets, realize you are paying a “QE Tax” to do so. This “tax” increases your out-of-pocket cost for those assets. Think of when you buy an airplane ticket and then are disgusted to see that so much of your purchase price is not to pay for your trip but is due to the myriad of taxes levied on top of your ticket revenues.

That is akin to what is happening when you buy stocks, bonds and real estate today. How high is the QE tax on your investments? It is very difficult to say exactly and different assets have different levels of “taxes” built into to their market prices. Suffice it to say however that without the $10 trillion in QE, bonds that trade with a 3% yield today could easily trade at 4.5% or higher yield. Even that level would constitute a 30% tax – the QE tax – that investors are paying today to buy those bonds or a stock or real estate given government’s direct distortions in the market.

……………………………………

At the same time, realize what government is doing gives gold the opposite value proposition. To frame QE’s impact on the price you must pay to buy gold, investors are essentially being given “investor food stamps” to buy gold. Imagine you go into a store and the price of an item is $20. But you have a $15 food stamp. So, you give the cashier your government issued $15 food stamp that you did nothing to earn, and only tender $5 of your hard-earned money. You then get to walk out with the $20 item you “purchased”. That is what is essentially occurring with gold pricing today given government interference in the capital markets. Clearly this is not government’s intention but it is an unintended consequence of its policies.

Why is that an appropriate comparison? Clearly if it were not for government buying, bond prices would be much lower (i.e., bond yields, and mortgage rates would be higher). Higher yields are the capital markets’ version of a canary in the mine, signaling there are problems in the financial system. When these classic free market warnings sound, investors reallocate to safer assets. With gold being an asset that has uniquely proven its value as liquid and safe, gold is a beneficiary of such portfolio re-weightings. Increased desire for safety has historically driven demand for gold higher and consequently the price of gold higher.

However, because the government has artificially driven up bond prices, investors have not heard the bond markets sirens as those warnings have been stifled by mountains of QE. Without the market warning signal, investors have not felt the need to increase safe haven weightings, and demand for gold has been artificially low. As a result, gold prices are artificially low.

Could our example actually constitute an approximate range – that ¾ of a fair value price for gold today is being paid by QE?

To answer that begin by asking yourself why does the Fed still own approximately 25% of all treasury bonds? The Fed has promised since 2009 it would divest itself of QE assets. So why hasn’t the Fed gotten around to its fundamental promise in the last 12 years?

And why does the government still own almost a third of mortgages?

The answer is simply that investors are not willing to pay today’s market prices to sustain these levels – so the Fed is stuck owning them, not wanting these overvalued assets to correct to what is really fair value. Perhaps this is a foreshadowing of Japan where the central bank of Japan owns 70% of some asset classes? The Fed began raising rates a ridiculously small amount recently given the magnitude of inflation. And the Fed only hinted at reversing QE without even meaningfully moving down that path. But just those tiny moves, essentially child’s play in light of what is needed, triggered an equity market correction of 20-30% in 1H22. Where would markets go if the Fed actually withdrew its $10 trillion in artificial stimulus? Suffice it to say the stock, bond and real estate markets would crater and, in the process, gold would likely move materially higher.

One Asian bank estimated that if 1% of global wealth shifted into gold from equities and fixed income, gold’s price would need to rise approximately 3x to accommodate such a small allocation shift. And so, our conclusion to the question how much higher would gold be without QE is that while we don’t know exactly, suffice it to say that you will probably never see another government subsidy of public investments the magnitude of which long term investors are being served in gold today.

………………………………….

We want to be clear – the definition of insurance is simply “a promise to pay”. Gold does not carry any promises and is not literal insurance. But to the extent that insurance theoretically provides relief in times of stress, gold has consistently done that through history, essentially functioning as de facto wealth insurance.

Examples of this include the great depression during which time stocks lost 80% of their value from peak to trough while gold emerged 70% higher. In 1987 the stock market fell 22% in one day and gold fell only 2% on paper and was even stronger in the physical markets. In 2000 the Nasdaq index fell 39% while gold only fell 5% and that low marked a generational bottom before gold rose 3x while stocks did nothing. And in 2008 when the S&P fell 38%, gold rose 5%. If one looks at the performance of gold from the period of Lehman Brothers’ collapse on 9/15/08 through the equity market bottom on 3/9/09, equities fell more than 40% while gold rose 17% in the same timeframe.

All of which begs the question, is gold’s slower than desired ascent really that bad? The only investors who could argue that are those with full allocations. We believe the key question for investors today is:

Is one’s gold allocation appropriately sized in a portfolio?

If an investor has a $5 million home yet maintains only a $50,000 fire insurance policy, one will feel remorseful if fire strikes with insufficient coverage especially if there were a high probability of fire.

Virtually no investors get to appropriately sized gold positions for their portfolios with their first purchase, just as many homeowners make installment payments on their wealth policy. Obviously, there are differences and again gold carries no explicit guarantee but there are also real similarities in this comparison.

Revisit what amounts you have invested in gold to date and the current value of your gold holdings relative to your net worth. You may also now conclude that you prefer a different gold weighting than what you previously considered was right sized for you have given how debts have expanded and other factors have unfolded.

And right now, the Fed is incenting investors to put their insurance policy in place at rates below where free markets would normally price gold policies.

……………………………………………………

We suggest investors choose not to get drug into focusing on micromanaging if inflation is reported lower for an in interim period – consider such a headline as a gift and nowhere near the end of the inflationary cycle. It is not a coincidence the dollar has lost 90% of its value in our lifetimes. The loss of purchasing power is triggered by money printing and that causes increases in prices relative to goods and services. The money printing trend is not reversing and history does not show any currency appreciating in value over time once it has reached the point of being overly indebted as we have today. Any diminishments in inflation are transitory on the road to lesser value in the purchasing power of unbacked currencies. Recognize the dollar’s strength at this moment on the global stage is only vs. other currencies backed by nothing. You see firsthand in your purchases that the dollar’s ability to purchase real goods has weakened considerably, a trend that augurs for reducing dollar exposure as Americans.

……………………………………………………

Pause for a moment and consider this admission.

Such a comment used to be considered the folly of conspiracy. What does it mean that the biggest stock bulls on the planet are now saying this is probable?

Munger also admitted that money printing like we are engaged in currently, “utterly destroy(s) the savings of the middle class”.

Why? Because historically the middle class would be paid in and save in paper assets rather than gold. If the middle class of Weimar or any other overly indebted nation had saved in gold, they would not have been wiped out.

Consider that statement applicable to the American middle class who until 1963 was the envy of history. Why did that end and what changed in 1963? The American working class were successful because America’s constitution insisted, they be paid in precious metals backed money. The evisceration of the American middle class took place because Lyndon Johnson smashed that constitutional mandate and converted the savings of the working class from metal into paper. LBJ then indebted the nation such that the currency has lost over 80% of its value since his treasonous act.

What of the future? Reflecting upon the differences between investing yesterday vs. investing in tomorrow, Munger said:

“In my lifetime it was the ideal time to own a diversified portfolio of common stocks … no other generation in the history of the world ever got returns like that. I don’t think the future is going to’ give … [paper investors] nearly that easy of an investment opportunity.”

Our working hypothesis is that future generations will look back on comments like these and be amazed that our generation was so educated yet still did not know how to prepare for the changing paradigm at hand today – a Once In A Generation shift.

Berkshire’s counterpart in the alternative asset space, Bridgewater Associates, runs the world’s largest hedge fund. Bridgewater’s Greg Jensen spoke of a 25% correction if the Fed simply has the gumption to move forward with what it has promised – pulling its money out of the financial system by right sizing its balance sheet.

And while Bridgewater is on record saying that if investors don’t own gold, they know neither history or economics, Berkshire suggested investors simply own stocks and apartment houses. This advice that is essentially to stay away from gold deserves skepticism because Berkshire itself admitted to building cash given how unattractive markets are today. Yet Munger suggested individuals stay fully invested, adding that in 100 years it is likely investors will be glad they did so… implying that between now and then there is a lot of pain to come for equity investors.

Remarkably Berkshire struggles to avoid ever suggesting investors hold gold despite its uber negative outlook on cash and the markets. Perhaps one day we will learn Berkshire has been pressured not to admit publicly the obvious benefit of gold in this environment for fear of roiling markets.

Today however, the absolute denial of most financial advisory firms as to the urgency to own some gold, plays into the hands of thoughtful investors who have less competition to buy metal.

…………………………………….

This extraordinary combination of soaring inflation costs and soaring dollar denominated debts could force entire nations as well as investors to sell paper assets to raise money just to secure sufficient energy and food. Gold may come under short term pressure in such a scenario for a brief time but should that occur we think it would be a late inning opportunity to add bullion to your portfolio cheaply. While the financial news is pre-occupied with the Fed’s next statement, we submit making sure your metals allocation is right-sized may be the top strategic priority in portfolio construction today. Given the data released Friday afternoon from the CME, commercial traders are more bullish on gold than they have been in over a year and commercial traders who generally hedge their physical metal in the paper markets are actually long silver in the paper markets as well. This unusually bullish positioning by the industry’s largest traders is worth considering as past occurrences of this anomaly proved attractive entry points. In Asia we have already seen premiums on physical gold widen to six-year highs, up three-fold in a month. In Europe we are now seeing silver inventories at the world’s largest metal market dip to under one year’s supply, a notable contraction.

The west is printing infinite amounts of paper money in a desperate attempt to push out the implications from its past mistakes especially with US elections just months away. Realize the extreme possible outcomes ahead and what lies between those extremes as it relates to investing. At one extreme if central banks renew their decade long commitment to money printing and this temporarily buoys markets, having a gold allocation will not likely be a material drag on portfolios. (Reference the data we presented in Once In A Generation where even 20% gold allocations in paper portfolios during the heyday of QE did not materially diminish the returns of 80% paper portfolios.) However, at the other extreme, if central banks are close to reaching their limit in terms of masking inflation and artificially elevating markets, some gold will likely prove a very valuable component of wealth preservation as detailed above. More scenarios between those extremes appear to favor gold as well.

How big is the mistake financial advisors are making in not counseling investors to allocate to physical gold?

Financial advisors saying that gold won’t protect your wealth is akin to the CDC saying that natural immunity won’t protect your health.

Our expectation is that most readers now feel the CDC created unnecessary fearmongering and needlessly pushed shots and that those who took the shots regret they did so.

You don’t want similar regrets of missing out on protecting yourself and your family with gold given how important history shows gold’s value is in a portfolio. Gold, the asset that has protected families without fail for centuries … and even aided in the protection of the Christ Child Himself.

May the God of Israel and may Jesus, the Christ and redeemer of mankind, send the Spirit of truth upon you to help you see through the fog of confusion so that you can protect your family and be a good steward of what has been entrusted to you. May He usher you to action that is in your best interests at this critical moment in history.

We would be honored to serve you and are happy to work with any open-minded financial advisors to customize solutions for client needs. We are blessed to serve clients across the spectrum from the working class to billionaires.

Our value add includes one of the most transparent online sites where we display our buyback prices on ~70% of our SKUs. Our client guidance through the IRA process may be without peer in the industry given investor feedback, our service and accessibility to clients garner positive reviews, and our value proposition relative to the industry that clients say has saved them thousands of dollars are all reasons to do business with us. We have what is arguably the best metals referral program in the USA in place, we pray for our clients as a firm daily and our commitment to our military police, firefighters and America make us a firm you will be glad you considered if you have not worked with us previously.

Please call, text or email with any questions you may have. Thank you.

www.StJosephPartners.com | info@stjosephpartners.com | 610.326.2000